Shopping for a vehicle is often not an easy decision. When it comes to leasing a Toyota car, it can be hard to understand the pros and cons. Some will decide to pay full cash for the vehicle, while others may consider leasing or financing one. It really is a personal decision depending on your financial situation and lifestyle.

But recently, leasing a Toyota car has become rather popular. The feeling of paying a smaller amount month-to-month makes the purchase easier to swallow for a lot of people, especially when we are in an age where everything from music subscriptions to phone bills is all on a monthly term.

And with new technology and car design coming out every year, it truly is quite tempting to change out every few years. So more people are now leasing a Toyota than ever, but is it right for you? Let’s take a look at the pros and cons of leasing a car.

Leasing a Toyota Car, how does it work?

Understandably, you may still not be fully clear on what leasing means. So before we get to the pros and cons of leasing a car, let’s understand what leasing really means first.

To lease a Toyota is similar to renting a car for a few years, at least initially. You get to try a brand-new car for a few years before deciding if you want to keep it. You can choose from leasing for 2 to 5 years (or 24 – 60 months) and the interest rate is lower when you choose a shorter term. Payments are available on monthly or bi-weekly terms.

Do I Have to Include a Downpayment?

Downpayment is not required but optional Some may say that it doesn’t make sense to do downpayment when leasing a Toyota car if you already know you won’t keep the new Toyota at the end of its lease; however, adding downpayment will help to lower the monthly payment amount as well as lowering the cost of borrowing since the total amount you will borrow is reduced.

The leasing option allows you to buy out the vehicle at the end of the lease term. The full amount, including applicable charges and taxes, is listed in the lease contract so you always know what you will be expected to pay if you choose to keep the car at the end of the lease. When leasing a Toyota car, the lease-end value is nearly always lower than the expected market value, which is why it is very enticing to buy out the vehicle. You will likely make some money back when selling it on the used car market.

What are My Options at the End of the Lease?

You don’t have to wait until the very end of your lease agreement in order to take action. For example, you can trade up for a new Toyota before then or make an early purchase at any point during your leasing period. You also get several options when it comes time to sign that final contract with Toyota and other manufacturers as well!

One thing many people do not realize is that even though they are signing a long-term financial commitment such as monthly payments over two years (or more), there are still decisions they will need to make about what happens after this initial term – like whether or not they want their first option be trading up into another vehicle within the range offered by Toyota dealerships.

No matter if you are at the end of your lease or if you decide to end the lease early when leasing a Toyota car, you have several options available:

Change To a New Car – return your current vehicle to the dealership and change to a brand new vehicle.

Return the Car – If you no longer need this car or another car after it, you can return the vehicle back to the dealership.

Buy out the Car – After you make regular payments and finish the leasing term. If you enjoy the car a lot, you may want to keep it for the long run. In this case, you can pay off the lease-end value of the vehicle either by paying full cash or paying it off through financing.

What are the Pros of Leasing a Toyota Car?

There are a number of pros and cons of leasing a Toyota car. Leasing is especially great if you tend to like to change up your style or if your lifestyle is likely to change over the years. It is also good for those that have a hard time deciding on a car or with a commitment since typically you can get out of the lease in as little as 50% of the way with very little cost if at all. Here are a few of the good reasons:

> Change To a New Car Every Few Years

Who doesn’t like the feeling of driving in a brand-new car, right? This is one of the best perks of leasing. Every few years, you can change up to something better. Since you have been steadily paying off the car, your credit is stronger and you won’t have to worry about not getting approved for the new car.

When you are done with the car, you no longer need to worry about selling it or trading it, since you can simply return it to the dealership and get a new car. If it is a Toyota, typically they have high value and will most likely help you get a lower payment for the next vehicle when you are trading it in.

> Lower monthly payments and downpayment

When you lease a Toyota car, the monthly payment is typically lower than financing when comparing the same term. This is true even when you do no downpayment. This option usually means you can get a higher trim or a better car since you have more money to work with.

For example, this is what leasing vs financing a 2021 RAV4 Hybrid looks like for 5 years with $0 downpayment at the time of this writing:

- Lease – $570/month

- Finance – $783/month

Or a 2021 Tacoma TRD Off Road for 5 years with $0 downpayment:

- Lease – $651/month

- Finance – $955/month

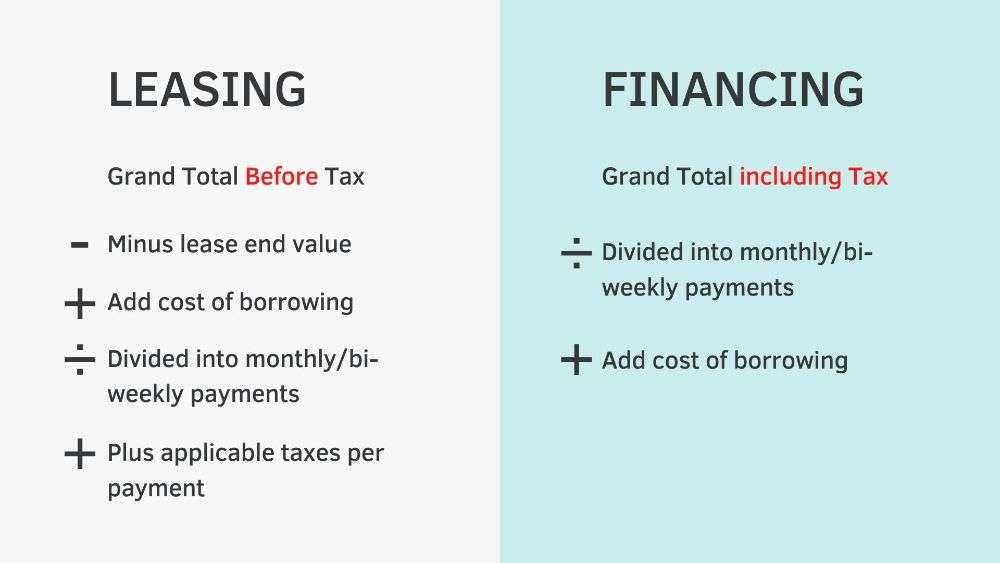

This happens because when you lease a vehicle through the Toyota lease program, you are only borrowing the difference between the total price plus applicable fees and the lease end value (which you only pay if you decide to buy the car out at the end of the term).

Another good thing is you are saving on not having to pay interest on tax. Unlike financing, tax is applied to the monthly amount instead of the full total, so you are not paying the cost of borrowing for the tax portion.

> Always Have Warranty Protection

Even on the longest lease term of 60 months, your Toyota vehicle will still have Powertrain Warranty coverage (given that you haven’t passed the 100,000km mileage limitation).

This makes leasing Toyota vehicles the best way to always ensure that you have warranty coverage for your vehicle, alleviating the need to worry about the cost of maintenance and breakdowns.

It will also save you from having to be concerned about whether to add an extension to the warranty. So whether you would normally extend it or not, you’d likely end up saving a bunch of money in the end.

> Always Have the Latest Features and Technology

Every year Toyota introduces new features to their vehicles to ensure you have the latest safety and technology. Isn’t it nice to always have the best and the latest?

Also, new and better safety features are always being added. The Toyota lease program will be the best option to get you access to the latest innovations and features as you get to enjoy it during its most trouble-free years.

And since most cars tend to get a full redesign every 4-5 years, your lease term is nearly guaranteed that you will end up with the design for the next redesign cycle.

> You Can Write-Off for Business Tax

If you own a business, it’s probably in your best interest to go for leasing as it allows you to write off a higher monthly payment amount than financing. Check with your local tax office for the full details.

> No trade-in hassles at the end of the lease

When the time comes that you’re ready to move on and get a new car, you won’t have to worry about depreciation and resale. The dealership you leased it from will handle everything—all you have to do is turn in the keys and decide what kind of car you want to lease next. It’s a big weight off your shoulders.

> Easy To Get Out Early

When you are leasing a Toyota car, it is very easy to end the lease early due to Toyota vehicles being highly desired on the market. In many cases, dealerships can help you get out of the lease with very little to no penalty, especially if you have already completed 50-60% of your lease term.

> Easier Credit Approval

Not everyone has good credit and that’s just life. The good thing is when you are leasing Toyota vehicles, the amount you are borrowing is much lower than when you finance a car… around half of the amount more or less. So if you have questionable credit scores, leasing would be your best bet to get that Toyota home.

If you have a bad credit score, the good news is that you are more likely to get approved by leasing the vehicle as opposed to financing. In fact, lease approval rates are often at 70% and higher, so your chances are pretty high of getting accepted.

> Lower Liability And Hassle When The Car Is Totaled

If before the lease agreement ends, your vehicle gets in an accident and is written off, Toyota includes GAP protection for their leases, which means all you need to do is call Toyota and they will work out the details and the payout with the insurance corporation so you wouldn’t have to bother with it. Your lease will end and you get to walk away without having to continue on with the payment for the vehicle. (This may be different for your state/country, please check with the local dealership for details).

> Increase liability when the car is totalled

If the car is totalled in an accident before the end of your lease, you may be liable for some costs not covered by your car insurance unless the lease includes car gap insurance. This type of insurance covers any costs that might be required before the lease expires, even if the car is scrap.

What are the Cons of Leasing a Toyota Car?

So far, it sounds like leasing is the winning option. Before you decide to go ahead to lease the next vehicle, you should also look at some of the potential downsides.

If owning your own car is a big thing to you, then you may not prefer to lease. Since you are likely to change to a brand-new vehicle every time the lease ends, you may never end up actually owning any of the cars.

Here are a few more reasons you may not want to lease a car:

> There are Mileage Limits

You must determine the maximum kilometres you will use for the full duration of the leasing term. Most Toyota lease programs offer as low as 16,000km annual mileage allowance. You can always increase the limit if you so desire.

The good thing is that the mileage is typically measured based on the total amount so as long as you don’t pass the total amount of mileage for the full contract, you won’t be penalized. If you think you have a good chance of driving a lot, you should increase the allowance at the point of purchase to avoid having to pay for the penalty, which can be 2 or 3 times more than if you had added the mileage from the beginning.

Keep in mind that if you tend to keep your vehicle in good or decent condition, there’s a very good chance that the dealership will buy the vehicle from you as opposed to having Toyota take your vehicle back. If the dealership will buy the car from you, then you won’t have to worry about going over the mileage limitation or getting penalized for it.

> It Could Cost You More Over Time

Because when you choose to lease a Toyota car also comes with the cost of borrowing, you will end up paying more money than if you just pay full cash for the car.

And when your lease ends, you may choose to change to a new vehicle on another leasing agreement. This will create a continual cycle of being on monthly payments. In the long run, this will add up to more money out of your pocket.

Especially when compared to buying a car at full price, or if you had bought out the car since either option would mean you can own the car without having to pay any additional monthly cost (aside from insurance and maintenance costs).

So if you can accept driving the same car for many years, paying full cash, financing or buying out the car at the end of the lease agreement would be a better choice for you.

> There could be wear-and-tear charges when you want to return the car

When you return the vehicle, it is expected that your Toyota is in good and reasonable shape. This may be easy for some people but hard for others, especially if you have kids or pets.

Toyota is typically more understanding when it comes to wear-and-tear, since their resale value is high, most dealerships will likely take them back even if it looks slightly roughed up. Wear-and-Tear protection is available as an option and some say you should take it as a just-in-case precaution.

While the vehicle is expected to be returned in the same shape as it was on the showroom floor, dealerships would more than likely prefer the car to look presentable for the next buyer.

If there are excessive damages, you may be asked to pay to cover the cost of fixing the damages or dings throughout the car.

> Restrictive with modifications or customization

If you end up returning the car back to Toyota, you should consult them ahead of time to see what modifications are allowed on the vehicle. If you wrap the car with customized colouring or branding, you may be required to remove it or pay additional fees to have it done for you if you decide to return the vehicle at the end of the lease.

How Do I Lease a Toyota Car?

Leasing a Toyota car comes with many advantages while giving you a lower payment when purchasing a new car which could mean you can buy a higher-end model. Here’s what you should do to lease a car:

> Find the Car That is Right For You

The first step is to settle on which trim and colour you want for your next Toyota vehicle. Choose the right one based on your current lifestyle and upcoming needs for the next few years.

> Test Drive the Car

> Work Out the Payment Details with the Salesperson

Now that you know which car you want, you can do a sit-down with a salesperson and work out the leasing payment and see if he can get you a reasonable payment for your budget. Consider adding some downpayment to lower the monthly amount and ask them about doing a Security Deposit to lower the interest rate.

> Finalize the Leasing Agreement

This is usually the point where you will sit down with a finance manager at the dealership. First, they will help you fill out a credit approval request and help you get approval, then they will review with you the terms and conditions for the leasing agreement.

> Take the new car home!

This is the happy part, now that you have got the approval, you can take the new vehicle home and enjoy your brand-new vehicle. Just make sure you either pay regularly or set auto payment for the leasing amount to avoid late fees.

Learn More About Leasing a Car

Here are a few posts that you may want to check out also relating to leasing a car:

Leasing a Car with Bad Credit: How to Qualify

Leasing a Car: Why is it Smart?

Conclusion

All in all, leasing is a great way to purchase a Toyota vehicle and is definitely worth considering if you have never done so before. So if you rather hold on to more of your money instead of using up a large chunk at once, and if you enjoy changing up your vehicle every few years, give leasing a try when you buy your next Toyota!